Learn how to find the best mortgage lender. Compare home loan options, mortgage rates, fees, and approval steps to secure the right loan for your needs.

How to Find the Best Mortgage Lender

Finding the right mortgage lender can make a huge difference in your homebuying journey. With so many options available, it’s important to know how to compare lenders, evaluate terms, and choose the option that fits your financial goals. This guide will help you understand the steps to secure the best mortgage for your situation.

Compare Home Loan Options

When searching for a home loan, you’ll come across different products from banks, credit unions, and online platforms. Some lenders focus on first-time buyers, while others specialize in refinancing. Understanding the type of loan you need helps narrow down your choices and makes the process easier.

Check Current Mortgage Rates

One of the most critical factors in choosing a lender is the mortgage rates they offer. Even a small difference in percentage can affect your monthly payments over time. Request rate quotes from multiple lenders to see who can give you the most competitive terms.

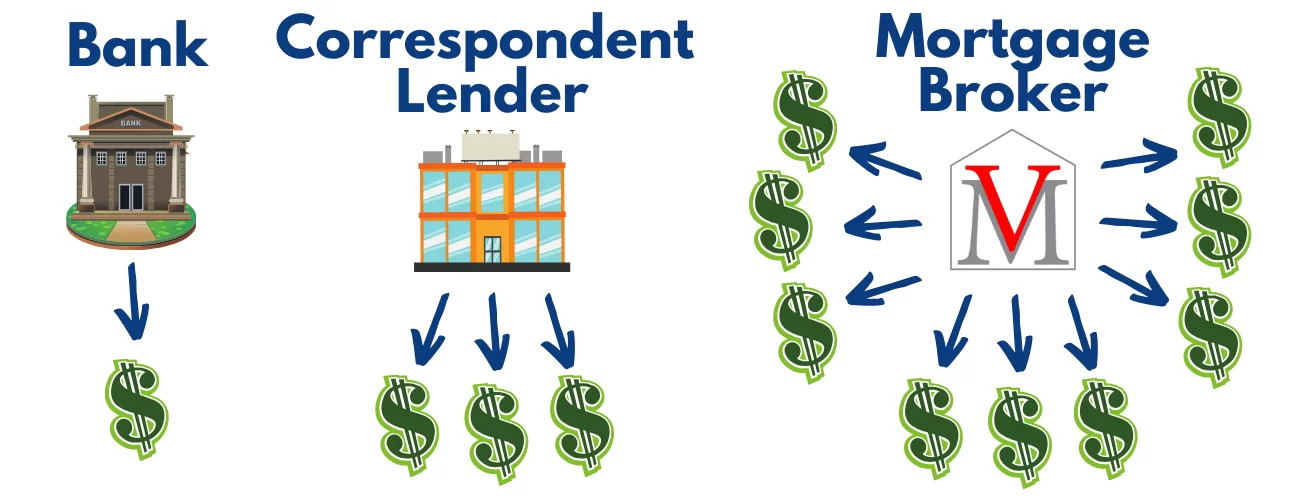

Mortgage Broker vs. Direct Lender

A mortgage broker connects you with several loan sources, while a loan provider (direct lender) works with you directly. Brokers can sometimes save you time by shopping around on your behalf, but it’s still smart to do your own research and compare the costs.

Look Into the Mortgage Company’s Reputation

The credibility of a mortgage company matters. Read reviews, check ratings, and see how they handle customer service. Reliable lenders provide transparent information and walk you through the process with patience.

Consider Refinancing Options

If you already own a home, a refinance lender may help you secure better terms or reduce your monthly payment. Refinancing can be especially helpful if rates have dropped since you first bought your property.

Understand the Mortgage Approval Process

Before signing any agreement, make sure you understand the mortgage approval requirements. Lenders will review your credit history, income, and debt-to-income ratio. Preparing documents ahead of time speeds up the mortgage process and improves your chances of approval.

Know the Loan Structure

Choosing between a fixed mortgage and an adjustable mortgage depends on your financial plans. A fixed-rate option provides stability, while an adjustable-rate loan may start lower but can increase later. Carefully weigh the pros and cons before making a decision.

Don’t Forget the Extra Costs

Beyond interest rates, you’ll face mortgage fees and closing costs. These may include origination charges, appraisal fees, and title insurance. Always ask your lender for a detailed breakdown so you aren’t surprised at the closing table.

Work With the Right Loan Officer

A knowledgeable loan officer can guide you through every step. They help clarify complex terms, answer your questions, and ensure you’re comfortable with your loan agreement.