Guide for Your First-Time Homebuying Loans and Programs

Introduction

Buying your first home is one of the biggest financial steps you’ll ever take. But it can also feel stressful if you don’t know where to start. Between saving for a down payment, meeting lender requirements, and understanding mortgage programs, first-time buyers often have questions.

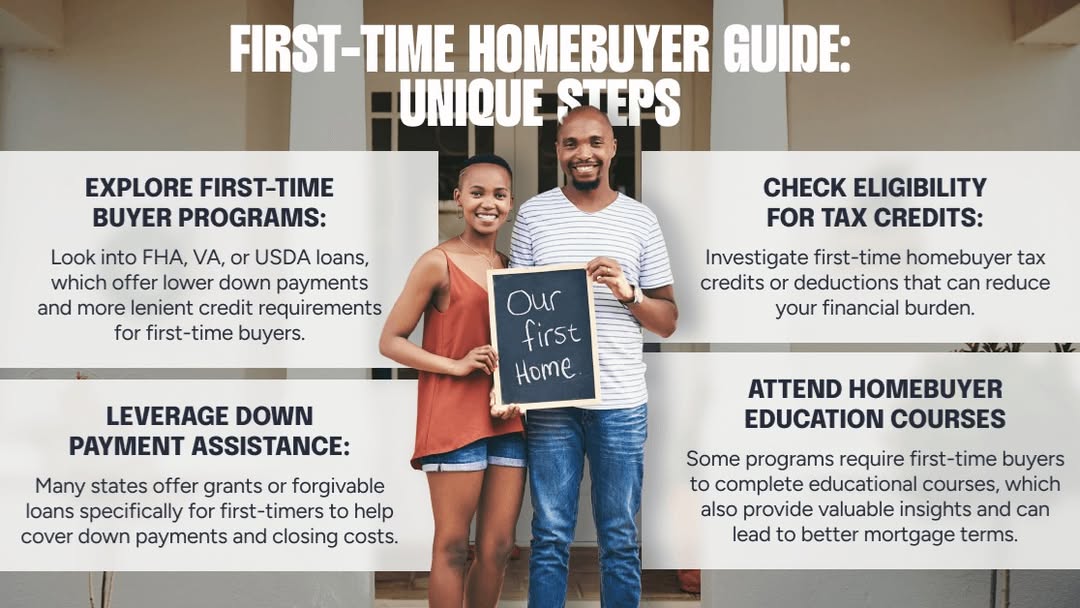

The good news is the U.S. has many first-time homebuyer loans and programs designed to make the process easier. From lower down payments to special grants, these options can help you move into your first home sooner without draining your savings.

This guide explains the most popular loan types, how assistance programs work, what you need to qualify, and tips to make your first home purchase smooth and affordable.

What Is a First-Time Homebuyer Loan?

A first-time homebuyer loan is a mortgage option created to help people buy their first home with fewer barriers. These programs usually provide:

-

Lower down payment requirements (as little as 3% or even zero in some cases).

-

Flexible credit score requirements.

-

Reduced interest rates.

-

Grants or assistance for closing costs.

Tip: Even if you’ve owned a home in the past, you may still qualify as a “first-time homebuyer” if you haven’t owned property in the last three years.

Top First-Time Homebuyer Loan Programs

1. FHA Loans (Federal Housing Administration)

-

Minimum Down Payment: 3.5% (with a credit score of 580 or higher).

-

Credit Flexibility: Buyers with scores between 500–579 may qualify with 10% down.

-

Best For: People with limited savings or less-than-perfect credit.

FHA loans are popular because they make homeownership more accessible, especially for younger buyers who don’t have a large savings history.

2. VA Loans (Department of Veterans Affairs)

-

Minimum Down Payment: $0

-

Mortgage Insurance: No PMI (Private Mortgage Insurance).

-

Best For: Veterans, active-duty service members, and eligible surviving spouses.

VA loans are one of the best deals available, offering no down payment and competitive rates.

3. USDA Loans (U.S. Department of Agriculture)

-

Minimum Down Payment: $0

-

Income Limits: Must meet area income requirements.

-

Best For: Buyers in rural and suburban areas.

USDA loans are designed to support communities outside major cities. They can be a strong choice if you’re open to living in a smaller town or suburban neighborhood.

4. Conventional 97 Loan

-

Minimum Down Payment: 3%

-

Credit Score Requirement: Generally 620+

-

Best For: Buyers with strong credit but limited savings.

This option gives you a low down payment while keeping you in a conventional mortgage program

Federal Assistance Programs for First-Time Buyers

Down Payment Assistance (DPA)

Many states and cities provide grants or forgivable loans that help cover your down payment and closing costs. These can make the upfront costs of buying a home much more manageable.

Good Neighbor Next Door Program

-

Designed for teachers, police officers, firefighters, and EMTs.

-

Provides homes at 50% off in certain revitalization areas.

-

Requires you to live in the home for at least 3 years.

Mortgage Credit Certificates (MCCs)

-

Allow you to claim a tax credit on part of your mortgage interest each year.

-

Available in many states through housing finance agencies.

State-Specific First-Time Homebuyer Programs

Every state has its own version of homebuyer support. Some examples:

-

California: CalHFA first-time buyer loans and down payment assistance.

-

Texas: My First Texas Home Program.

-

New York: SONYMA (State of New York Mortgage Agency) programs.

-

Florida: Florida Housing First-Time Homebuyer Program.

Always check with your state’s Housing Finance Agency (HFA) to see available grants, tax credits, or discounted loans.

Requirements to Qualify for First-Time Homebuyer Programs

While exact requirements vary, here are common qualifications:

-

Credit Score: Typically 580+ for FHA, 620+ for conventional.

-

Income: Some programs have income limits (varies by location).

-

Debt-to-Income Ratio (DTI): Lenders usually prefer under 43%.

-

Property Type: Must be a primary residence, not an investment property.

-

Down Payment: 0%–3.5% depending on the program.

Pro Tip: Get pre-approved by multiple lenders to compare your options.

Steps to Apply for a First-Time Homebuyer Loan

Check Your Credit Score – Review your credit report and fix errors.

Set a Budget – Know how much you can realistically afford.

Research Loan Options – Compare FHA, VA, USDA, and conventional loans.

Get Pre-Approved – This strengthens your buying power when making an offer.

Apply for Assistance Programs – Don’t skip local or state grants.

Work with a Real Estate Agent – Pick one experienced with first-time buyers.

Tips to Make the Process Easier

-

Save early for your down payment, even small amounts add up.

-

Pay down high-interest debts to boost your credit.

-

Avoid new credit card accounts or big purchases before applying.

-

Keep financial documents ready (tax returns, pay stubs, bank statements).

Common Mistakes First-Time Buyers Should Avoid

-

Buying more house than you can afford.

-

Skipping pre-approval.

-

Not checking multiple lenders for the best rate.

-

Overlooking closing costs.

-

Forgetting about property taxes and insurance.

Conclusion

Buying your first home doesn’t have to be overwhelming. Thanks to first-time homebuyer loans and programs, you can get help with your down payment, qualify with lower credit, and access grants that make homeownership affordable.

Whether you go with an FHA loan, explore state-specific grants, or qualify for VA or USDA programs, the key is to prepare, compare options, and take advantage of the help available.

Your dream of becoming a homeowner may be closer than you think — and with the right guidance, you’ll be ready to open the door to your very first home.

Frequently Asked Questions (FAQs)

Do I need a 20% down payment to buy a house?

No. Many first-time buyer programs allow you to buy with as little as 3% or even 0% down.

Can I get a loan with bad credit?

Yes. FHA loans are designed for buyers with credit scores as low as 580 (or 500 with a larger down payment).

How do I know if I qualify for down payment assistance?

Eligibility depends on your income, location, and the specific program. Check your state housing authority.

Do I need to be a U.S. citizen to qualify?

Not always. Many programs are open to permanent residents and some visa holders, but requirements vary.

How long does the process take?

Not always. Many programs are open to permanent residents and some visa holders, but requirements vary.